Why? It is because according to the Tennessean, the economy is paramount. According to the Tennessean, It's 'Time for Another Change.' They go on to say, America needs strong leadership; yet, our leaders in Washington have seldom looked more impotent.

One of the key ways to build this economy again, is to keep tax rates low.

During the vice presidential debate between Congressman Paul Ryan and Vice President Joe Biden, Ryan said Republicans would work with Democrats in Congress to lower federal income tax rates 20%, while denying many existing deductions used by taxpayers. He defended Romney against charges he will not specify the deductions he would target.

"What we're saying is here's our framework,'' Ryan said.

Biden said the GOP ticket will keep loopholes for wealthy investors by taxing capital gains at lower rates than regular income. He said Ryan's proposal, to lower rates and still preserve some deductions, was "impossible'' to achieve without raising taxes on the middle class or growing deficits.

Here is a part of that dialogue:

Ryan. It is mathematically possible. It's been done before. It's precisely what we're proposing.

Biden. (Chuckles....showing all pearly whites) It has never been done before.

Ryan. It's been done a couple of times, actually.

Biden. It has never been done before.

Well, here are two examples of when the tax rate was lowered and revenue increased.

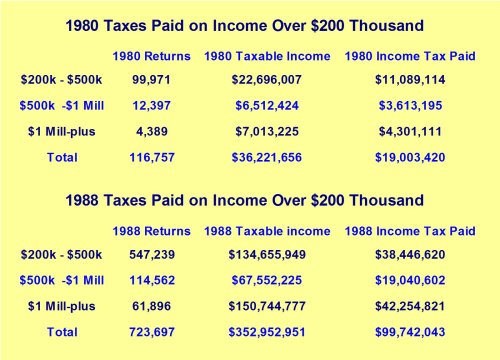

Results of Lower Taxes Paid in 1980 & 1988

There’s lots of data here, but pay close attention to the columns on the right and see how much income tax was collected from the rich in 1980, when the top tax rate was 70 percent, and how much was collected from the rich in 1988, when the top tax rate was 28 percent.

The key takeaway is that the IRS collected fives times as much income tax from the rich when the tax rate was far lower. This isn’t just an example of the Laffer Curve. It’s the Laffer Curve on steroids and it’s one of those rare examples of a tax cut paying for itself.

I have confidence that we can teach folks on the left that tax policy affects incentives to earn and report taxable income.

Results of Lower Taxes Paid in 1964

In 1964 Congress passed, and Lyndon Johnson signed into law, a big income-tax cut that had originally been proposed by John F. Kennedy. The top marginal rate dropped from 91 percent to 70 percent, which represented a 23 percent cut. The bottom rate dropped from 20 percent to 14 percent, which represented a 30 percent cut. The middle rates dropped from 59 and 62 percent to 45 percent, which represented a cut of 24 percent to 27 percent. So we start out with one significant difference between the Kennedy and the Romney plan. Romney and Ryan want to lower taxes by the same amount for all brackets, high and low. Kennedy (really, Johnson) lowered taxes more at the middle and especially at the bottom than he did at the top.

In each case, the end results were a restoration of economy freedom and additional revenues.

Facts are stubborn things; and whatever may be our wishes, our inclinations, or the dictates of our passion, they cannot alter the state of facts and evidence ~ John Adams.

Will these facts have a bearing on the upcoming election? We may know the answer to this question on November 7, 2012...unless we have a repeat of the Bush v Gore 2000 presidential election.

Brought to you by CharlottePAC.com.

In each case, the end results were a restoration of economy freedom and additional revenues.

Facts are stubborn things; and whatever may be our wishes, our inclinations, or the dictates of our passion, they cannot alter the state of facts and evidence ~ John Adams.

Will these facts have a bearing on the upcoming election? We may know the answer to this question on November 7, 2012...unless we have a repeat of the Bush v Gore 2000 presidential election.

Brought to you by CharlottePAC.com.

No comments:

Post a Comment